Rumored Buzz on Property By Helander Llc

Rumored Buzz on Property By Helander Llc

Blog Article

Property By Helander Llc Things To Know Before You Buy

Table of Contents5 Simple Techniques For Property By Helander LlcProperty By Helander Llc - TruthsGet This Report on Property By Helander LlcThe 5-Minute Rule for Property By Helander Llc7 Simple Techniques For Property By Helander LlcProperty By Helander Llc for Dummies

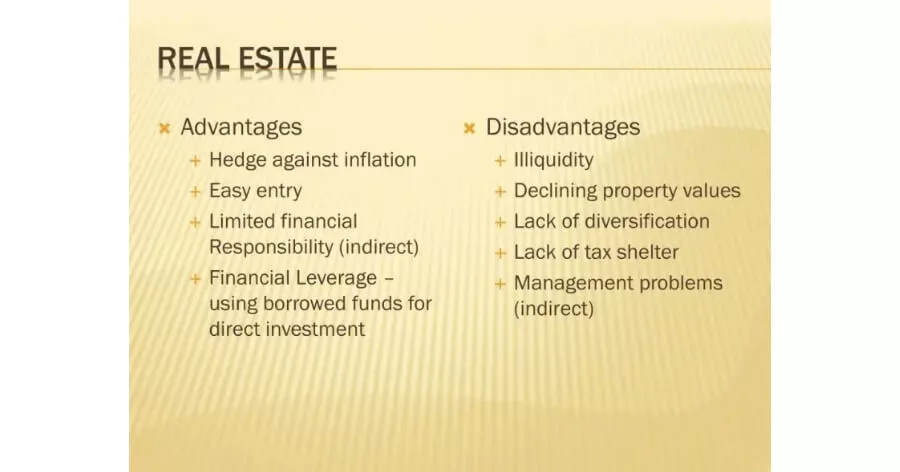

The advantages of purchasing real estate are countless. With well-chosen possessions, capitalists can take pleasure in predictable cash money circulation, excellent returns, tax advantages, and diversificationand it's feasible to take advantage of real estate to develop wide range. Considering purchasing realty? Below's what you need to understand about property advantages and why actual estate is taken into consideration a great financial investment.The benefits of investing in genuine estate include easy earnings, steady cash circulation, tax advantages, diversification, and leverage. Actual estate financial investment trust funds (REITs) use a way to invest in genuine estate without having to possess, operate, or money buildings.

In many instances, cash flow just strengthens with time as you pay down your mortgageand accumulate your equity. Actual estate investors can make the most of numerous tax obligation breaks and deductions that can conserve money at tax time. Generally, you can deduct the sensible costs of owning, operating, and taking care of a building.

Some Known Facts About Property By Helander Llc.

Realty values tend to raise gradually, and with a great investment, you can transform an earnings when it's time to sell. Rents additionally often tend to climb with time, which can bring about higher capital. This chart from the Federal Book Bank of St. Louis reveals typical home prices in the U.S

The locations shaded in grey suggest U.S. economic crises. Median Prices of Houses Sold for the United States. As you pay for a residential property home mortgage, you build equityan possession that belongs to your total assets. And as you develop equity, you have the leverage to purchase more residential properties and raise capital and wealth even a lot more.

Due to the fact that realty is a concrete possession and one that can work as collateral, funding is easily available. Property returns differ, relying on elements such as location, property course, and monitoring. Still, a number that numerous capitalists intend for is to beat the typical returns of the S&P 500what many individuals describe when they state, "the marketplace." The inflation hedging capability of property comes from the positive partnership in between GDP development and the need for actual estate.

Property By Helander Llc for Dummies

This, in turn, translates right into higher capital values. Genuine estate tends to maintain the buying power of resources by passing some of the inflationary stress on to renters and by including some of the inflationary stress in the form of funding recognition. Home loan loaning discrimination is illegal. If you assume you have actually been differentiated against based on race, faith, sex, marriage condition, use public help, nationwide beginning, special needs, or age, there are steps you can take.

Indirect genuine estate investing involves no straight possession of a property or buildings. There are numerous methods that owning genuine estate can secure versus rising cost of living.

Homes funded with a fixed-rate car loan will certainly see the relative amount of the monthly home loan repayments fall over time-- for circumstances $1,000 a month as a fixed settlement will become less troublesome as inflation deteriorates the purchasing power of that $1,000. (https://lwccareers.lindsey.edu/profiles/5452152-frederick-riley). Typically, a main home is not considered to be a real estate investment best site considering that it is used as one's home

The 30-Second Trick For Property By Helander Llc

Despite the help of a broker, it can take a couple of weeks of job simply to find the ideal counterparty. Still, realty is an unique possession class that's easy to understand and can enhance the risk-and-return profile of a capitalist's portfolio. On its own, actual estate uses cash money flow, tax breaks, equity structure, affordable risk-adjusted returns, and a hedge versus rising cost of living.

Investing in real estate can be an unbelievably rewarding and financially rewarding endeavor, yet if you resemble a great deal of brand-new financiers, you might be wondering WHY you need to be buying genuine estate and what benefits it brings over other financial investment chances. Along with all the remarkable benefits that go along with buying property, there are some drawbacks you require to consider also.

A Biased View of Property By Helander Llc

At BuyProperly, we make use of a fractional possession version that enables capitalists to begin with as little as $2500. Another major benefit of actual estate investing is the ability to make a high return from purchasing, remodeling, and marketing (a.k.a.

Most flippers look for undervalued buildings underestimated great neighborhoods. The terrific thing concerning spending in genuine estate is that the value of the residential property is expected to value.

Property By Helander Llc Fundamentals Explained

If you are billing $2,000 rent per month and you incurred $1,500 in tax-deductible expenditures per month, you will just be paying tax on that $500 revenue per month (realtor sandpoint idaho). That's a huge difference from paying taxes on $2,000 monthly. The profit that you make on your rental for the year is thought about rental income and will be taxed accordingly

Report this page